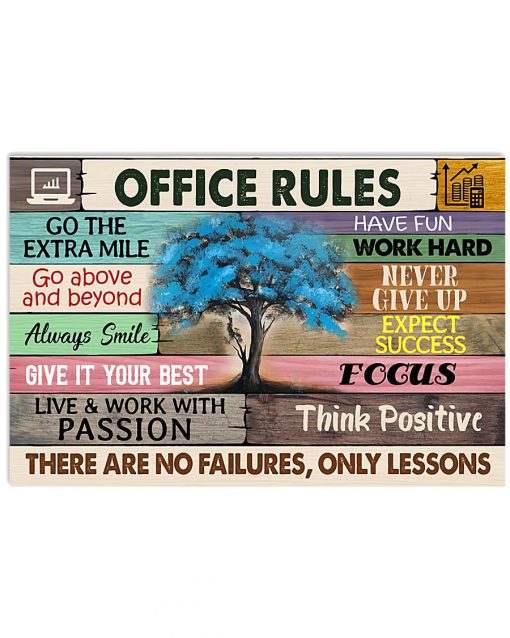

Accountant – Office Rules Poster

- Comfortable fit.

- Ship from 4-6 days

- High quality

Buy this product here: Accountant – Office Rules Poster

Home page: Blinkenzo Store

———————————————

Related Posts:

We recognize, we comprehend: you have got been stuck inner for a superb yr, in a single corner of your kids’ now-unused bed room, adjusting the seasoned lighting you bought for Zoom classes, debating the advantage of the brand new desk chair you bought. You’re blissful you sprang for 3 screens, now not only 1, but you nevertheless believe you’ll want to have bought a sooner computing device.

You spent all year becoming a house workplace perfectionist, and right here comes your payoff. It be tax time, and that means or not it’s time to add up the entire methods you spent to build your home office and get something lower back for it.

the following checklist covers the necessities of itemizing deductions in your home workplace. In spite of the fact that you utilize some slick tax utility equipment, or despite the fact that you might have bought a good accountant, or not it’s price a couple of minutes to believe in regards to the most essential checklist items before you interact with either of those approaches.

additionally: The most useful tax application for groups or own education

Who qualifies? Not personnel!

Let’s get one very important aspect out of how: You cannot, repeat, cannot deduct the cost of the use of your domestic if you are an worker.

or not it’s correct there in the instructions for form 8829 of the internal salary carrier, “expenses for enterprise Use of Your home”: “You cannot declare expenses for company use of your home as an worker.”

Or buy here : Accountant – Office Rules Poster

https://www.pinterest.com/pin/962081539116513721

https://twitter.com/Blinkenzo1/status/1365498945565118464/photo/1

ACCOUNTANT – OFFICE RULES POSTER

Why no longer? It seems nearly a merciless joke, however the 2017 Tax Cuts and Jobs Act, passed long before most people expected a pandemic, removed the use of miscellaneous itemized deductions, which changed into the instrument through which people could typically declare unreimbursed work prices as an worker, together with the use of the home.

With hundreds of thousands of individuals now working for their organisation out of the den or a spare bed room after the children have long past to faculty, it might be fine if employees could use that miscellaneous deduction. However such isn’t the case. (despite the fact, some states, including long island and California, will let taxpayers claim domestic charges once they file.)

The elimination of miscellaneous itemized deductions is meant to be temporary, expiring in 2026. However some would want to make it everlasting. Texas senator Ted Cruz final month added a bill to make everlasting the removal of miscellaneous itemized deductions whereas raising the limit of the general deduction.

exclusive and foremost are the watch phrases

Visit our Social Network: Blinkenzo Pinterest, Twitter and Our blog Blinkenzo blogspot